This company undergone a disastrous merger and stock price has languished for many years. Activists came in and shook up management, resulting in a change in CEO. So market watchers are hoping that things might finally go right. In fact, management wants to get things right so much so they published an investment case deck themselves for investors to look at.

Again let’s look at the numbers again. It still has quite a fair bit of debt (>EUR30bn) as a result of the big merger that it did. But FCF generation is strong and therefore there is an additional deleveraging story which will benefit stockholders.

Simple financials (Dec 2023 estimate, EUR)

Sales: 49.9bn

EBITDA: 12.3bn

Net income: 4.1bn

FCF: 3.5bn

Debt: 33.2bn, Mkt Cap 50.5bn

Financial Ratios

ROIC: 8.4% and ROE: 17.2%

EV/EBITDA 6.6x (Dec 24)

PER 6.8x (Dec 24)

Past margins: OPM c.10% (been volatile)

FCF yield: 6.9%

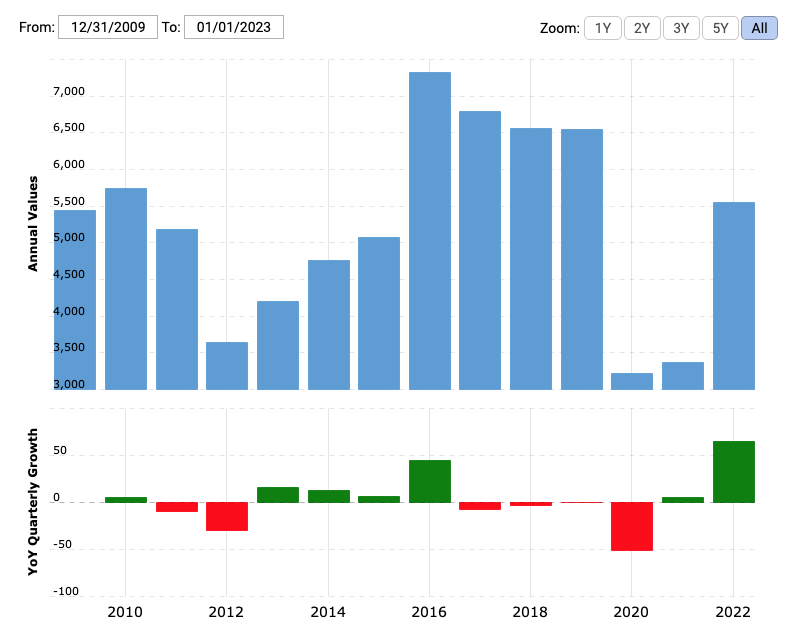

The following shows the usual FCF over the years, thanks to macrotrends.net. It has been hit by the pandemic but we can also see that the numbers are recovering strongly.

Keep reading with a 7-day free trial

Subscribe to 8% Value Investhink to keep reading this post and get 7 days of free access to the full post archives.