It was reported that Singapore lost >SGD500m to cybercrime in 2023. Imagine, our small country of a few million people, losing that much. What would that number be in China, US and Europe? Based on population sizes, it could be 300x more ((China’s 1.3bn + US’ 300m + Europe’s 500m) / Singapore’s 6m = 300). That’s USD150bn!

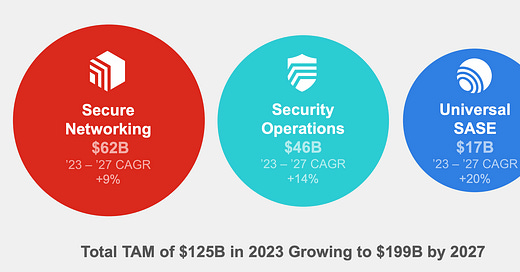

The company we are discussing today is one of the cybersecurity play listed in the US. Recently, the firm published some good quarterly investment materials and we shall be highlighting many of the key slides here starting the one on Total Addressable Market. The company estimates that its TAM is currently USD125bn but will grow to USD200bn by 2027.

Cybersecurity is big business!

Next, let’s take a look at the simple financials. It is also worth noting that the company has generated high teens growth to sometimes 30% YoY growth for more than 10 years.

Simple financials (Dec 2024 estimate, USD)

Sales: 5.5bn

EBITDA: 1.7bn, EBIT 1.5bn

Net income: 1.2bn, FCF: 1.7bn

Debt: -1.0bn (net cash), Mkt Cap 38.7bn

Ratios

ROE >100%, ROIC 70%

EV/EBITDA 21.7x (Dec 24), PER 29.9x (Dec 24)

Past margins: OPM 15-20%

FCF yield 4-5% (4.4% based on no.s here)

As one the leaders in the cybersecurity space, the company has also enjoyed stable high margins, extraordinarily high ROICs and good Free Cashflow. Due to its recent earnings weakness, shared price collapsed, presenting an opportunity for us to buy. That said, it is still not cheap with PER at close to 30x based on consensus no.s although it looks better with c.5% FCF yield.

1. Fundamentals

Cybersecurity is a megatrend with hackers being way more sophisticated vs 20 years ago and companies and individuals needing more software and solutions to protect themselves. The company has projected market growth to be c.12% but its own revenue has grown close to 20% over the last 15 years.

The company has implemented its own rule of 40 stating that revenue growth and operating margins should exceed 40 in any given year. As we can see, it has comfortably achieved this over the last 5 years. Management is also focused on Free Cashflow and it started generating billion dollar FCF in 2021 and looks like it should hit USD2bn this year.

Keep reading with a 7-day free trial

Subscribe to 8% Value Investhink to keep reading this post and get 7 days of free access to the full post archives.