This is a short commentary about UOI and not a full review for the stock to be in the portfolio. Interested readers, please click the following newslink for context.

https://sg.news.yahoo.com/minority-investor-says-uoi-over-014825695.html

Activism is coming into Asia and Singapore. It has already taken Japan by storm. It may take years, or even decades but it is a matter of when, not if. Why? Because tonnes of Asian stocks trade below book. In Singapore, >50% of our listed stocks trade below book. We are worse than Japan (which only has 40%).

We have listed stocks trading at 0.03x price to book. More than one. There is Sapphire Corp, China ShenShan Orchard and Fuxing China Group. All trading at 0.03x. (See screenshot below).

Take the case of Fuxing China Group trading at $3.15m (not enough to buy a 3-bedroom condo in Singapore) which is at 0.03x book value. What it means is that you can buy the company for $3.15m today (technically, you may need to pay a takeover premium but let’s keep it simple), but the net assets on its balance sheet is worth c.$100m. Isn’t that the bargain of the century?

Alas no. I dug into its financials. $50m of that is account receivables, which is money not paid to Fuxing yet. The other $50m is supposedly depreciated property, plant and equipment: its factories and facilities. Apparently, Fuxing make zippers in China. Someone needs to fly down and check those assets. They may not be there. So, yup, even though its 3c to the dollar, nobody is buying.

But there are real unpolished gems around. Usually companies that are, for one reason or another, trading very cheaply for some time already. That is when activists come in to try to unlock value. Today’s story is about the curious case of United Overseas Insurance (UOI) with an individual activist.

First, let’s look at UOI’s financial numbers:

Simple Financials (Dec 25 estimate, SGD)

Sales: 100m, Net income: 30m

Operating Income: 35m, Investment Income: 17m

Debt: -100m (Net cash), Mkt Cap: 477m

Investments: c.414m of which 47m in Haw Par shares

Financial Ratios

ROE: 6.5%, ROIC: 2.6%

PBR: 1.0x (Dec 25)

PER: 15.9x (Dec 25)

Dividend: 23 cents per share, Yield: 2.9%

UOI used to trade below book but has since rallied because the said individual activist called management out via the media. The market got interested and bought the shares up. However, without more firepower, it might be difficult to create genuine change.

That’s the difficulty and complexity about activism. Many things need to fall in place. E.g. Low allegiant shareholder ratio. Latent value that needs to be unlocked. Potential angle to catalyse some transformation and importantly, the core business should be sound and valuations should make sense.

Here’s the usual Fundamentals, Technicals and Valuation framework.

1. Fundamentals

United Overseas Insurance operates a simple business of selling insurance via Singapore’s second largest banking group - United Overseas Bank (UOB) Group. It is a unique bancassurance business which has enjoyed steady growth alongside Singapore’s economy (or perhaps more relevantly, Singapore’s property market). By leveraging on the UOB Group’s infrastructure, UOI has also been able to keep underwriting cost low (no agents and lower IT cost), thereby generating steady underwriting profits.

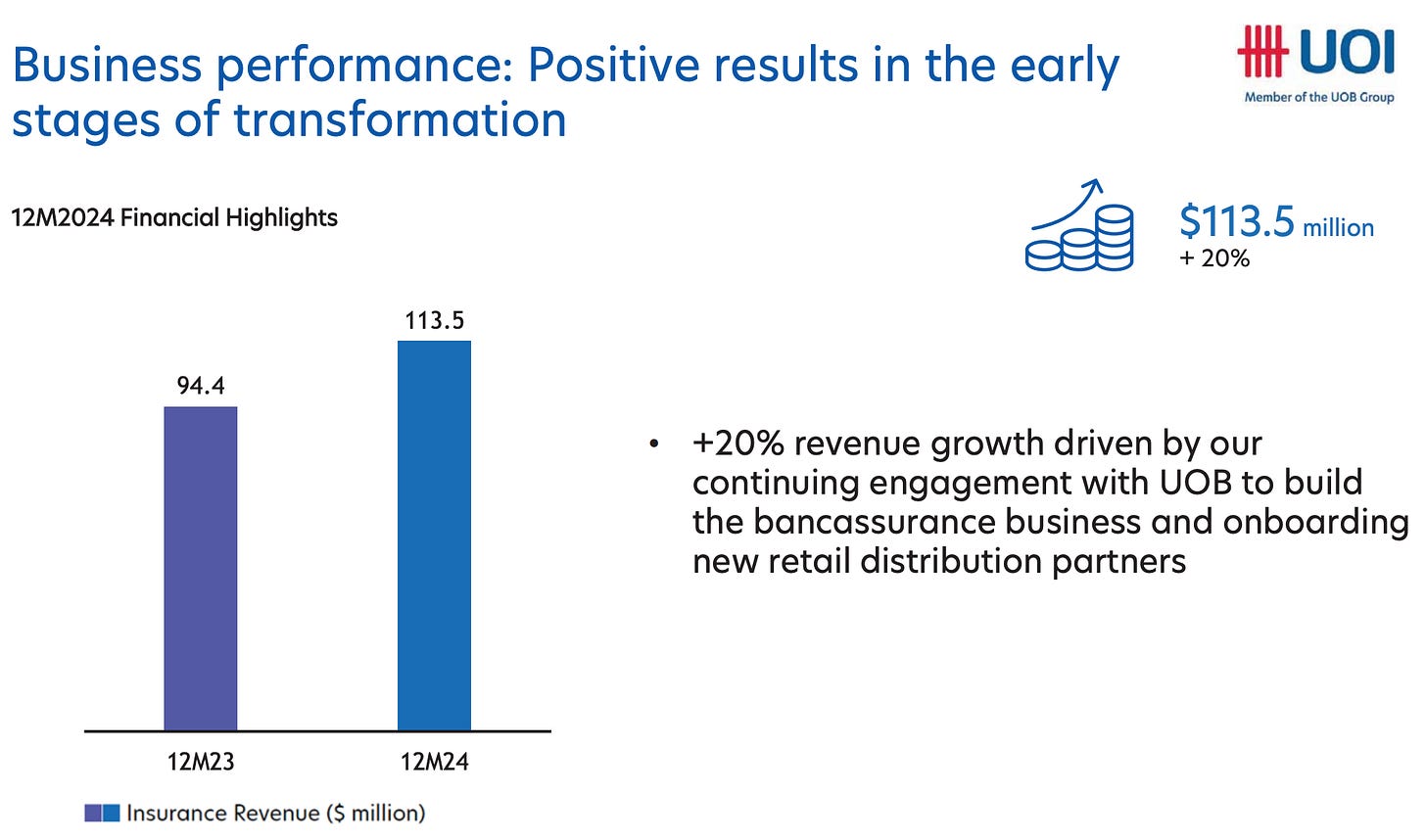

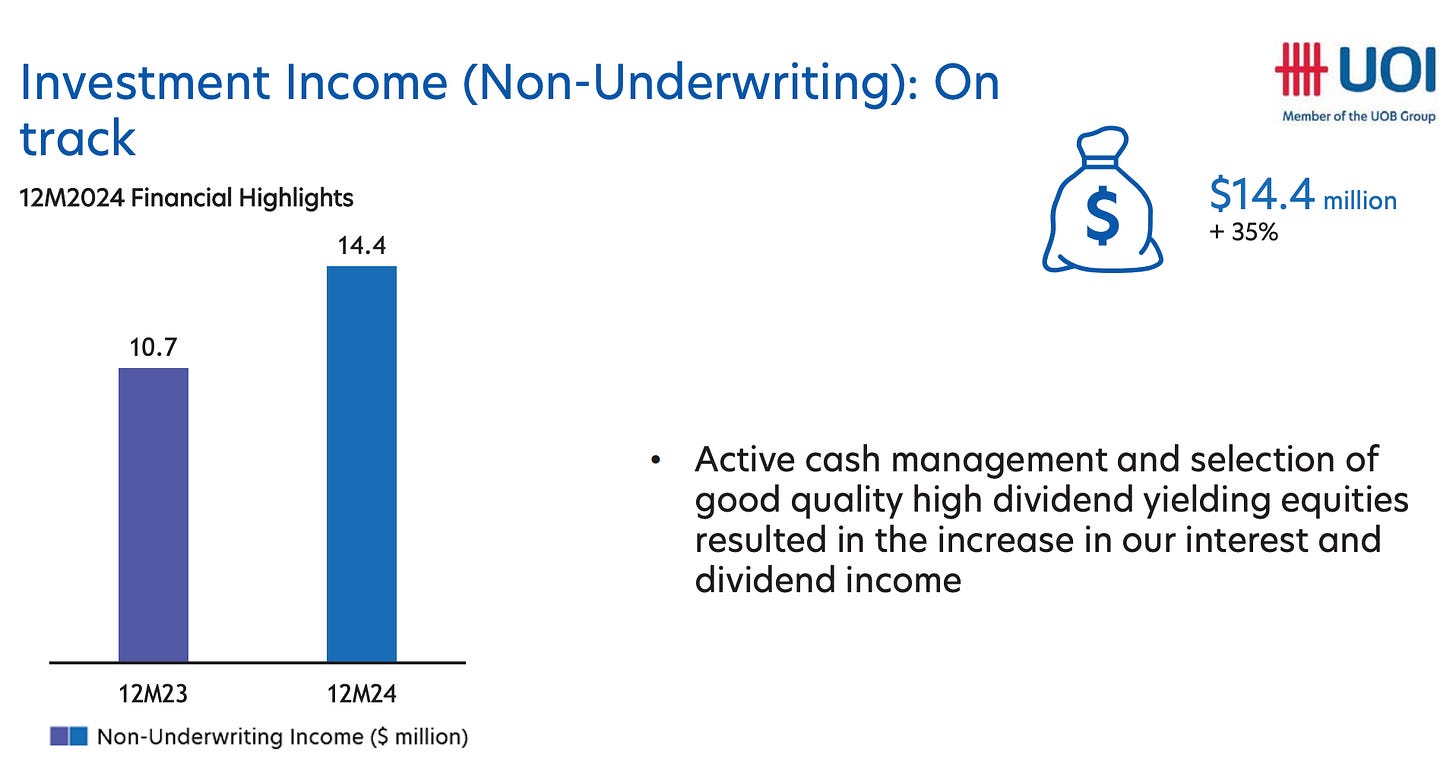

Actually, both underwriting and investment profits had done well. From what I can tell, UOI had positive investment income for the past few years. These are deduced from the slides below:

It is not clear if other income is investment income. My assumption is yes or likely the bulk of it. The slide above shows it has been positive from 2018-2022 and the next slide shows 2023-24 did well too. Investment profits had grown last year as a function of the stock market.

UOI uses its own inhouse asset management team and Schroders and both adopt conservative investment strategies and have, by and large, made returns. In short, it’s a decent business. Okay, let’s discuss the elephant in the room.

Activism in Singapore: What’s really the crux of the issue here is that an individual activist has called out poor management under UOB’s leadership. He believes that UOI is over-capitalized (>400% capital adequacy ratio) and should sell stuff to return capital to investors and he proposed the following two resolutions:

Resolution 1: To distribute UOI’s 4,274,600 ordinary shares in Haw Par Corporation directly to UOI shareholders.

Resolution 2: To appoint a financial advisor to evaluate strategic options for maximising shareholder value.

As we can expect, UOI threw them out, citing no legal requirement to put these to the vote. What transpired was a tense shareholder meeting which we all get to learn more a little bit more about UOI’s business. The minutes are in the link below.

Due to the lack of disclosure, it is hard to analyze UOI. What we know is that it runs a profitable general insurance business (after selling the life insurance to Prudential) and pays 2+% dividend yield. It used to be cheaper, but thanks to the spotlight being shone on it now, share price has rallied.

The investment thesis should still be intact though.

Investment Thesis

UOI enjoys an interesting niche general insurance business (Residential mortgage, property, personal accident) in Singapore with its lower-than-industry cost base by leveraging on UOB’s group infrastructure. It enjoys marginal growth alongside the strength of Singapore’s property market. Recent shareholder activism while un-successful would keep management on their toes to continue to increase its dividend payout (currently 47% payout ratio).

Risks

Conversely, the risk is that management decides to do the opposite, since the activist would never gather enough shares to mount any serious challenge to the UOB group (which owns c.60% of UOI). It is a given that UOI will not sell Haw Par shares nor change anything that the activist demanded (even though he may be right, and especially if he is right, that’s how politics work right?). The only hope is that dividend can be raised because the UOB group will also benefit.

Should that not happen, share price will then trade at where it is now and we can only eat the 2+% dividend or worse, the bigger risk is that share price corrects back to a lower level (c.$6.50 from current $7.70). That’s 18% downside!

2. Technicals

Next, technicals. The chart below shows how UOI is trading near its all-time high, again, thanks to activist action. As mentioned, should some drawdown occur, share price could hit $6 or c.28% downside from current levels. During the GFC, the drawdown was c.50%.

3. Valuations

As usual, in this final section, we discuss valuation. Free Cashflow (FCF) is not used to value financial companies so we have to use dividends (DVD) instead. To recap, the earnings row (below) is my invention. It uses dividend, EBITDA and Net income for the respective valuation metrics (Dividend yield, EV/EBITDA and Price Earnings). We then apply the appropriate multiple to the metric.

To illustrate, for Price Earnings Ratio (PER), the row shows SGD30m, which is the net profit and for Enterprise Value (EV), the row shows my estimate of SGD40m for UOI’s EBITDA. With the respective multipliers we have intrinsic value per share of $7.36 and $6.54 respectively.

For the first column, which uses dividend (DVD), UOI is paying out c.SGD15m annually and I have put a 30x multiple which means this stock should trade at 3.33% dividend yield. Looking across the three metrics, we see no upside at current prices. Of course, a lot depends on the multiples used and we can debate that in the comments below.

To conclude, UOI’s curious story continues to develop. Can an activist with just a small percentage share really change things in Singapore like what is happening in US or Europe? Today, the short answer is no. Founding families control their listed companies, they are also powerful management and they probably still have both the media and other shareholders’ support.

As evidenced, UOI’s support ratios during this AGM proxy voting were between 94-99%. But who knows, things could change in a few years. When there is succession, stakes get sold down. Families lose control. Activists come in. That’s what happened to Japan. It might spread to Asia and Singapore!

Huat Ah!

This post does not constitute investment advice and should not be deemed to be an offer to buy or sell or a solicitation of an offer to buy or sell any securities or other financial instruments.