As mentioned in my other posts, they are over 1,000 shareholder activist campaigns globally today. British Petroleum, Japan’s Fuji Media and Korea’s Nongshim Noodle, just to list a few household names.

Even Singapore’s United Overseas Insurance is targeted! We hope this substack’s pivot to discuss more activist stories will drive subscription :)

Today, we would like to discuss Swatch. We have looked at Swatch for donkey years and wrote a tonne of materials about it. See below:

https://8percentpa.blogspot.com/search/label/Swatch

Since then, share price underperformed big time. To us, there is no surprise that an activist came in and now trying to shake things up. It might be interesting to do more research now and perhaps add this to the portfolio.

This post will not be a full analysis. More like a preamble. We will keep this short and sweet for now. Provide a brief background, tell the activist’s story and how the founding family reacted and set the stage for the bigger analysis.

Here we go!

1. Background

Swatch Group (Market Cap USD8.9bn, EV/EBITDA 8.8x), while being known for its plastic, colourful, quartz wristwatches for kids and youngsters, is actually a watchmaking conglomerate. Swatch owns Omega, with all the heritage - worn to the moon and all, which could have become a premium luxury watch brand like Rolex, but that did not happen. It also owns both mass-tige and high end watch brands like Longines and Breguet amongst others.

In 2013, Swatch bought jewellery brand Harry Winston as one of the early steps to compete against LVMH, the world’s largest luxury player and also its arch-nemesis, Richemont. While it created much hype back then, management did not follow through. Supposed synergies and growth did not come and Swatch’s growth stagnated and free cashflow generation also collapsed.

Meanwhile, LVMH became Europe’s largest company by market cap (only recently overtaken by Novo Nordisk) and Richemont double its market cap to almost CHF100bn, which is 10x bigger than Swatch over the 10-15 years.

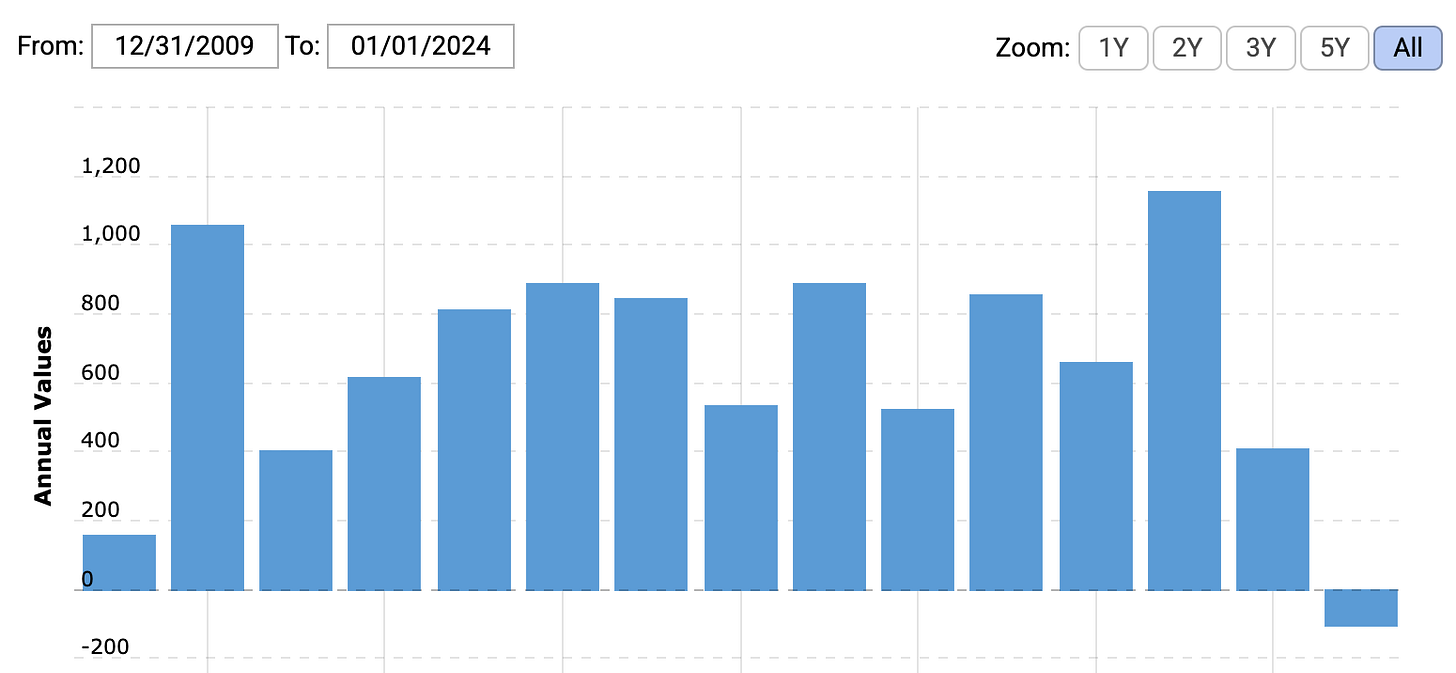

In the same time period, Swatch’s market cap more than halved. Its financial ratios became pretty dismal, as we can see above. Both ROE and Operating Margin are at 4+%. Price-to-Book is at 0.6x. The founding family, with two generations of family members running the business and owning majority of the company, are burying their heads in the sand, resisting advice.

Under its founder Nicholas Hayek, Swatch used to be a FCF generating machine. But after he passed, mis-management has caused FCF to turn negative. This was the result of declining margins, ballooning of its inventory (unsold watches) and increasing capex.

Swatch also has CHF1.4bn in net cash, which together with its inventory of CHF7bn, amounts to more than its market cap. In fact, Swatch recently met Ben Graham’s Net Net (Current Asset - Total Liability > Market Cap) criteria. Which is somewhat unthinkable for a luxury company.

2. Activist’s Side of the Story

As such, activists found this name. Steven Wood of Greenwood Capital, owning 0.5% of Swatch, called out Swatch’s management. He would like to see the company engaging shareholders and asked for seat on the board. As expected, Swatch’s management poo-pooed him and voted down his request for a board seat.

However, it seemed unlikely that this is the end of the story. For the share price to collapsed so much to become a net-net, it seemed difficult to justify Swatch has done a lot of things right. There is definitely room to improve margins, ROEs and to think about the six point plan (below) that Mr Wood has raised.

1. Breguet: Improve the retail experience, add personalization programs at scale, reduce the wholesale channel variety and improve residual values. We believe these steps can make Breguet once again king of the Swiss watch industry.

2. Harry Winston: Emphasize the brand’s core design elements through annual collections that both reinforce the icons and the exceptionally rare jewels that the group is known for. With annual collections taking the opposite approach as Van Cleef and Arpels, the goal is to replicate Hermès Birkin playbook for unoccupied ultra-high-end jewelry industry.

3. Omega: Increase collaborations to expand the collection, and target audience. A key priority is to add new collaborations, staying true to the brand’s core DNA but aimed to make the brand more relevant with Gen Z. Utilize what’s working and “hot” in the vintage market to inform new design trends and take a few more risks with selected exclusive editions.

4. Capital Markets: Strengthen perception and credibility of the company in the capital markets and media by creating an offensive narrative, as opposed to letting others define the company’s story. Continue to increase transparency and add an entrepreneurial Investor Relations officer to help management stay focused on the business. By regaining a more rational valuation, this will improve stakeholder perceptions of organizational culture, lead to higher employee satisfaction, higher productivity, ultimately benefitting all stakeholders.

5. Brand Marketing: Increase marketing spend, funded by removing overhead burden, to double-down on storytelling for the incredible historic brands and ongoing innovation within the group. Remove layers in between founding family, executives and the company’s core employees of doers, sellers and inventors.

6. Technology Innovation: Expand the group’s innovations across the portfolio brands by layering in technology into replaceable and upgradeable bands.Courtesy of https://www.watchpro.com/activist-investors-six-point-plan-to-strengthen-swatch-group/

2. Founding Family Strikes Back!

Alas, the founding family is not interested. They believe they know their business best. They would say it was because of China. Once China recovers, all will be good. They believe analysts and investors know shit and so, while they own >50% of the company, it is difficult to see how things could change.

Mr Wood’s next best strategy would be to talk to buyers who might be interested to privatize Swatch. But again, the family has controlling stake and it’s their call whether they want to sell. The cynical thinking here is that perhaps the family wanted to take Swatch private themselves, hence they drove the share price down to be a net-net!

Then we need minority protection to work. I asked A.I. and it seemed that minority shareholders might have good protection. Although Mr Wood may need to raise his stake to 5% to be more effective.

To conclude, Swatch looks interesting as a net-net. Mr Wood’s first salvo did not do much but it has definitely put Swatch on global investors’ radar as a super cheap yet somewhat quality stock. Even if very little is achieved, Swatch might just rebound when business recovers. So this stock deserves a deeper research.

To be continued!

Huat Ah!

This post does not constitute investment advice and should not be deemed to be an offer to buy or sell or a solicitation of an offer to buy or sell any securities or other financial instruments.